Estate planning is a process that involves making arrangements for the transfer of your assets after your death. It can include things like money, property, and personal possessions.

It guarantees the allocation of your assets according to your wishes, rather than being determined by state laws or a court.

Estate planning is essential for several reasons. It not only ensures that your assets are delivered to their rightful owners but also diminishes family disputes and conflicts.

With proper planning and strategies, you may be able to reduce the taxes your estate and heirs will need to pay.

Despite the importance of estate planning, most people overlook it and fail to invest the time and effort required to create a proper plan.

In fact, according to a recent survey, only 34% of American adults will have an estate plan in place in 2024. That highlights the need for greater awareness and education and underscores the potential risks and consequences of failing to do so.

In this article, we will discuss seven tips that can help you avoid estate planning mistakes.

1. Work with Professionals

Estate planning can be a complex and highly technical process that requires knowledge and experience. When choosing a professional to work with, it’s vital to consider their qualifications, experience, and reputation.

You may also want to consider their communication style and whether they make you feel comfortable and confident in their abilities.

You can visit https://www.wealthenhancement.com/s/trust-services to find professionals who can guide you through the process and ensure your plan is legally sound and tailored to your needs.

Working with a professional can provide several benefits. They can help you understand complex legal and financial concepts, identify potential areas of risk or concern, and recommend strategies to reduce taxes and protect your assets. They can also assist in ensuring that your plan is up-to-date and compliant with the law.

2. Make a List of Your Assets

Making a list of your assets is another aspect of creating a successful estate plan. Your assets include everything you own, such as your home, investments, bank accounts, and personal property.

Creating an inventory of your assets can help you identify what you have, what you owe, and whom you want to inherit your assets from after your passing.

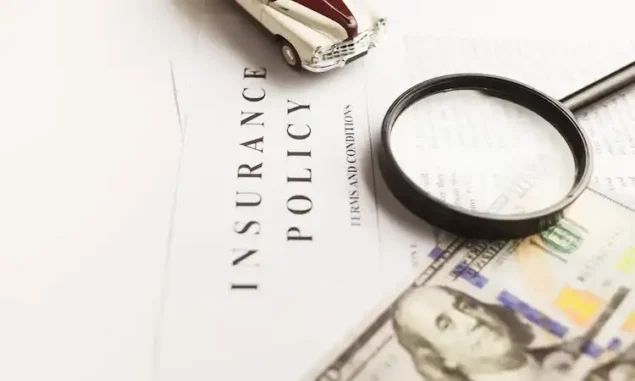

It can help ensure you don’t forget anything important when creating your estate plan. It’s easy to overlook assets such as life insurance policies, retirement accounts, or digital assets.

It also helps you get a clear picture of your financial situation. It can help you determine how you want your assets accessible among your beneficiaries and whether you need to take steps to protect your assets from creditors.

3. Consider All Aspects of Your Estate

Many people focus solely on the distribution of their assets during estate planning. While this is a vital part of the process, it’s also important to consider other aspects of your estate, such as your legacy and how you want people to remember you.

You can include provisions for charitable giving in your estate planning. Many methods, like a charitable trust or a donation in your will, can be used to accomplish this. By including charitable giving in your estate plan, you can help support causes that are important to you and leave a lasting impact on the world.

Another aspect to consider is end-of-life care. It’s crucial to consider the kind of medical care you would want if you become incapacitated and unable to decide for yourself. You may want to consider creating a living will or a health care proxy, which can give someone you trust the authority to make medical decisions if necessary.

4. Prevent Family Conflicts

Estate planning involves making decisions about the distribution of your assets and cares in case of incapacity, and these decisions can sometimes create tension or conflict among family members.

You can create an estate plan that addresses these issues and helps prevent disputes among your loved ones. For instance, if you have kids from multiple marriages, you might want to consider how to split your wealth equally among them or leave anything to a surviving spouse without taking anything from your kids.

Consider how to communicate your wishes to your family members clearly and sensitively. It can help prevent misunderstandings and conflicts down the road.

5. Think About Trusts

Trusts can be a valuable tool in creating a successful estate plan. A trust is a legal entity that holds assets for the benefit of a designated beneficiary. You can avoid probate as the law states that assets held in trust can bypass probate. It saves time and money for your loved ones, as probate can be a lengthy and expensive procedure.

If you have minor children, a trust can manage their inheritance until they reach a certain age or milestone. It can aid in ensuring it is used wisely and to their advantage. Trusts can also protect assets from creditors, lawsuits, and divorce settlements.

6. Keep Your Documents Organized & Secured

Estate planning involves creating legal documents such as wills, trusts, and powers of attorney that outline your wishes and instructions for the distribution of your assets and care in case of incapacity. Keep these documents in a location that is both secure and convenient.

This can prevent confusion and disputes among family members and beneficiaries after your passing. For example, if you have a will, you want to ensure that the original document is in a secure location like a safe drawer or a bank vault and that your executor knows where to find it.

7. Review and Update Your Plan Regularly

Life is unpredictable, and your circumstances can change in unexpected ways. By reviewing and updating your estate plan regularly, you can ensure that it remains current and effective.

For example, changes in your family situation, such as the birth of a child or the death of a loved one, may require adjustments to your estate plan.

Changes in your financial status, such as a significant increase or decrease in assets, may also necessitate revisions. Similarly, changes in your health, such as a diagnosis of an illness, may require adjustments to your end-of-life care provisions or powers of attorney.

It’s important to note that estate planning is an ongoing process, therefore, stay proactive and regularly review your plan.

Conclusion

While estate planning may seem overwhelming or even daunting, it’s important to remember that this is a critical aspect of responsible personal and financial planning. It is a way to take control of your future and ensure that your wishes are fulfilled.

Follow these seven tips to create a plan that meets your unique needs and provides peace of mind to you and your loved ones. So, don’t put off estate planning any longer – take charge and create a comprehensive plan now.